For one, GoPro has very different margin levels. For another, while the camera industry have been shrinking over the years, it seems that GoPro has buck the trend and produced significant growth, albeit shrinking growth rate. No surprising considering the company had multiple triple digits year. Given the very different circumstances, using comparables' multiple become suspect. Having said this, I decided to embark on valuing the company using a DCF instead.

In order to value GoPro using a DCF, the following inputs are required:

a) Revenue Growth Rate

b) Terminal Growth Rate

c) EBIT Margins

d) Tax Rates

e) Reinvestment Requirements

f) Cost of Capital

Revenue Growth Rate

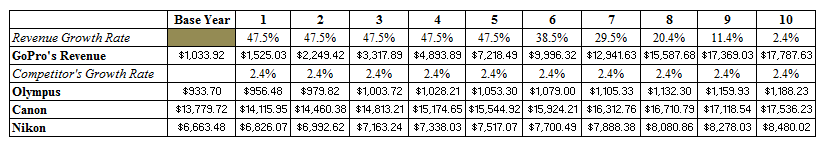

In order to estimate revenue growth rate, I believe it is appropriate to compare it against the company's competitors.

From the picture above, one can see that GoPro owns only a small size of the camera market. This doesn't necessary have to be a bad thing. It represents market share that GoPro could potentially grab. Of course, GoPro products are niches as compared to its competitors which provide a wider range, but lets just assume GoPro is able to grow its revenue to be more inline with competitors. Why not right?

Assuming GoPro is able to grow its revenue to that inline of Canon, the market leader, the implicit returns is as follow:

Terminal Growth Rate

As you can see from the picture above, the terminal growth rate is 2.4%, or more specifically, 2.44%. This is the US 10 year bond rate. I expect the industry to grow inline with the economy.

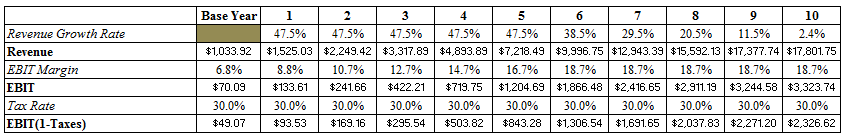

EBIT margin

Since I am looking for the bull case scenario to formulate a margin of safety on shorting GoPro, I have decided to use the highest EBIT margin that GoPro, Olumpus, Canon and Nikon have made over the last 6 years. The highest EBIT margin of 18.7% came from Canon back in 2011. This assumes that GoPro will more than double its existing margin. Well, why not?

Tax Rate

As for Tax Rate, I use a tax rate of 30%. Doesn't really make sense considering that the company operates in US, which have a 40% corporate tax rate, and had a 41% tax rate in the LTM. Again, why not?

Reinvestment Requirement

Currently, the average reinvestment requirement over the last 4 years of GoPro is 33.5%. Rather than using a 33.5% reinvestment requirement, I use a 25% reinvestment requirement. The lower the reinvestment requirement, the more aggressive the valuation.

Cost of Capital

Rather than using a growing company cost of capital, I use a lower, more aggressive 8.0% mature company cost of capital.

With all this factor in play, the intrinsic value of the company comes up to be $158.28 per share. or a 85.2% upside from current prices. Of course, my assumption takes into account of extremely aggressive, near the point of hilarity, assumptions.

Using a more conservative, albeit still aggressive assumption, value per share drops from the stratosphere. Just by using a 30% initial growth rate, a 15% EBIT margin, a 40% tax rate and a 30% reinvestment rate, value per share drops to $40.85 per share, or a 52% downside to current prices.

In my opinion, shorting GoPro at $85.46/share represents an attractive opportunity.

No comments:

Post a Comment