Link to Japfa Ltd financial model: https://www.dropbox.com/s/y7dyb0x5owhmv5x/JAPFA%20FINANCIAL%20MODEL.xlsx?dl=0

The problem with capital-intensive company with high margins is that is is hard to sustain that margins. This is because if whatever is driving high margins is a result of capital expenditures, existing industry players or new entrance could easily lever up and drive down margins. Japfa Ltd has this risk.

Japfa Ltd is an agri-food company that produces multiple protein food (poultry, milk, etc) in five emerging Asian markets, most notably, Indonesia.

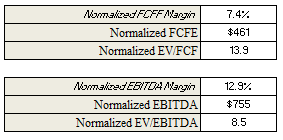

In the Indonesian segment, the poultry industry is highly concentrated, with the top 2 players owning over 50% of the DOCs and Animal Feed markets. This market concentration has led to Japfa Ltd to have a significant margin on their revenue in comparison to its western comparables such as Tyson Foods. Tyson Foods operates primarily in the United States, where the protein industry is fragmented, and thus has lower margins. For example, Japfa Ltd has a 9.5% EBITDA margins, while Tyson has a 5.8% EBITDA margin. This is a massive premium.

At the same time, operating in emerging markets means that expected growth rate is significant. When you have a capital intensive company that operates in a high growth environment, capital is crucial as capital expenditure will be high. The Indonesia poultry market is expected to grow in the mid-high teens for at least the next 5 years, and the China dairy market (which Japfa Ltd also operates in) with similar, if not higher growth rate. This is massive growth.

So now the real question is this. Can Japfa Ltd meet the expected growth rate in the industry in which it operates in?

I believe the answer is no.

Japfa Ltd already has a (EBITDA - Maintenance CAPEX)/ Net Interest Expense ratio below 1, maintenance CAPEX being an adjusted inflation rate by geographical segment, let alone expansionary CAPEX. What this means is that the company is unable to service its interest expenses after spending cash on CAPEX. As a result, maintenance CAPEX cannot be fulfilled, UNLESS, the company is able to fund its CAPEX requirements from external sources, such as through an equity and debt offering. This was what they did. The problem with doing an equity offering is that it dilutes value if the stock price is undervalued.

By the way, what I mean by maintenance CAPEX is the cost required to keep current production going. Expansionary CAPEX, on the other hand, is the cost required to maintain market share.

So the alternative is a debt offering. A debt offering would be accretive to value, so long as the return on incremental capital is above the cost of debt. With a headline ROIC and a cost of debt of 16% and 6.8% respectively, this seems to be the way to go. However, if this is indeed true, the company should not have done an equity offering as that would be dilutive. There must be a reason.

I think the reason is two-folds.

1) Headline ROIC and cost of debt is erroneous. I believe true ROIC is below the current 16% as a result of a highly inflationary environment. Such an environment would result in future replacement cost (maintenance CAPEX) to be higher than historical cost. If one uses maintenance CAPEX in lieu of D&A, ROIC would drop below cost of debt. In addition, cost of debt might be depressed as total debt includes ~$400 million of revolving credit, which interest may not be reflected on the income statement. Since a debt offering would in fact be damaging to results, an equity offering is the alternative.

2) Listing in the SGX allows the company to gain access to a more liquid financial market. This allows the company to refinance at lower rates. However, this would not be helpful as the return on incremental capital will likely still be below the adjusted cost of debt. I believe this is true because in 2013, Japfa Comfeed, a subsidiary to Japfa Ltd, issued $225m of SECURED SENIOR debt of 6%. This is above the adjusted ROIC of sub 4.0%.

Back to answering the question, if the company is unable to produce returns above the cost of debt, this means that the company should not raise debt to finance its maintenance CAPEX, as that would ultimately be value destructive. Thus, the company would not be able to keep ongoing operations running, lest they raise capital through further equity offering (which is dilutive), let alone keep up with the industry expected growth rate.

However, growth rate has to flow somewhere and I believe it would follow to industry players that are not as levered as Japfa Ltd. An example would be Malindo, which has a Debt/EBITDA of 1.7x and a (EBITDA - Maintenance CAPEX)/Interest Expenses of 4.8x, as compared to Japfa Ltd, which has a Debt/EBITDA of 3.8x and a (EBITDA - Maintenance CAPEX)/Interest Expenses of <1x.

What this implies is that the industry is likely to undergo fragmentation and this would depress EBITDA Margin, which would further accelerate fragmentation. With a 9.5% EBITDA margin compared to Tyson Foods' EBITDA margin of 5.8%, margin compression has a long way to fall.

Margin compression, massive debt burden and elevated valuation multiple...this could be a recipe for disaster.