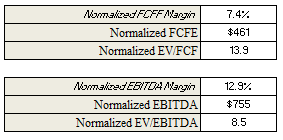

It currently trades at HK$4.58, or a normalized 13.9x EV/FCF or a 8.5x EV/EBITDA. I believe that Giordano is likely undervalued with tremendous upside.

While I do not have much of an unique insight in the apparel industry, I believe that the risk reward makeup on Giordano is more than enough to make up for this deficiency.

Giordano is a company which has tremendous cash generating capabilities. This is reflected in it having a normalized ROIC of 96.0%. This is possible because the company has a large, albeit cyclical, franchise base. This also explains why the company would choose to return capital back to shareholders via dividends instead of reinvesting it.

However, due to a challenging outlook in 2014 and the reality being as such. Giordano suffered a 49% decline in earnings in 1H14. The result? A faltering share price. But, as the adage goes,

"Be fearful when others are greedy, and greedy when others are fearful", I believe this is the time to be greedy.

At HK$4.58, the market implies that Giordano would have a steady state growth rate of -0.68%. While this is possible, I do not find it probable, considering its geographical location and product offering. In addition, the company has a 6.2% CAGR for the last 9 years and the market does not seem to have a good reason to explain such a large discrepancy.

At HK$4.58 and a terminal growth rate of 2.5%, this represent a 106% upside. In the meantime, you will own an undervalued company that pays a 7.5% dividend. In a yield-starved environment, this represents an excellent opportunity.

No comments:

Post a Comment